what is a secondary property tax levy

FY 202122 Tax Levy chg. Levy 2018 type 2019 taxes taxes 2019 tax summary totals secondary property tax prmreduction primary property tax special district.

Your Assessment Notice And Tax Bill Cook County Assessor S Office

The secondary tax is comprised mainly of commitments to satisfy bond indebtedness of jurisdictions fund voter-approved budget overrides and to support the operations of the.

. 2 Property Tax In. Credit reporting agencies may find the Notice of Federal Tax Lien and include it in your credit report. What is a secondary property tax levy Monday August 29 2022 Edit.

Levies are different from liens. Starting in 2022 the state is offering some matching. What is a secondary tax levy.

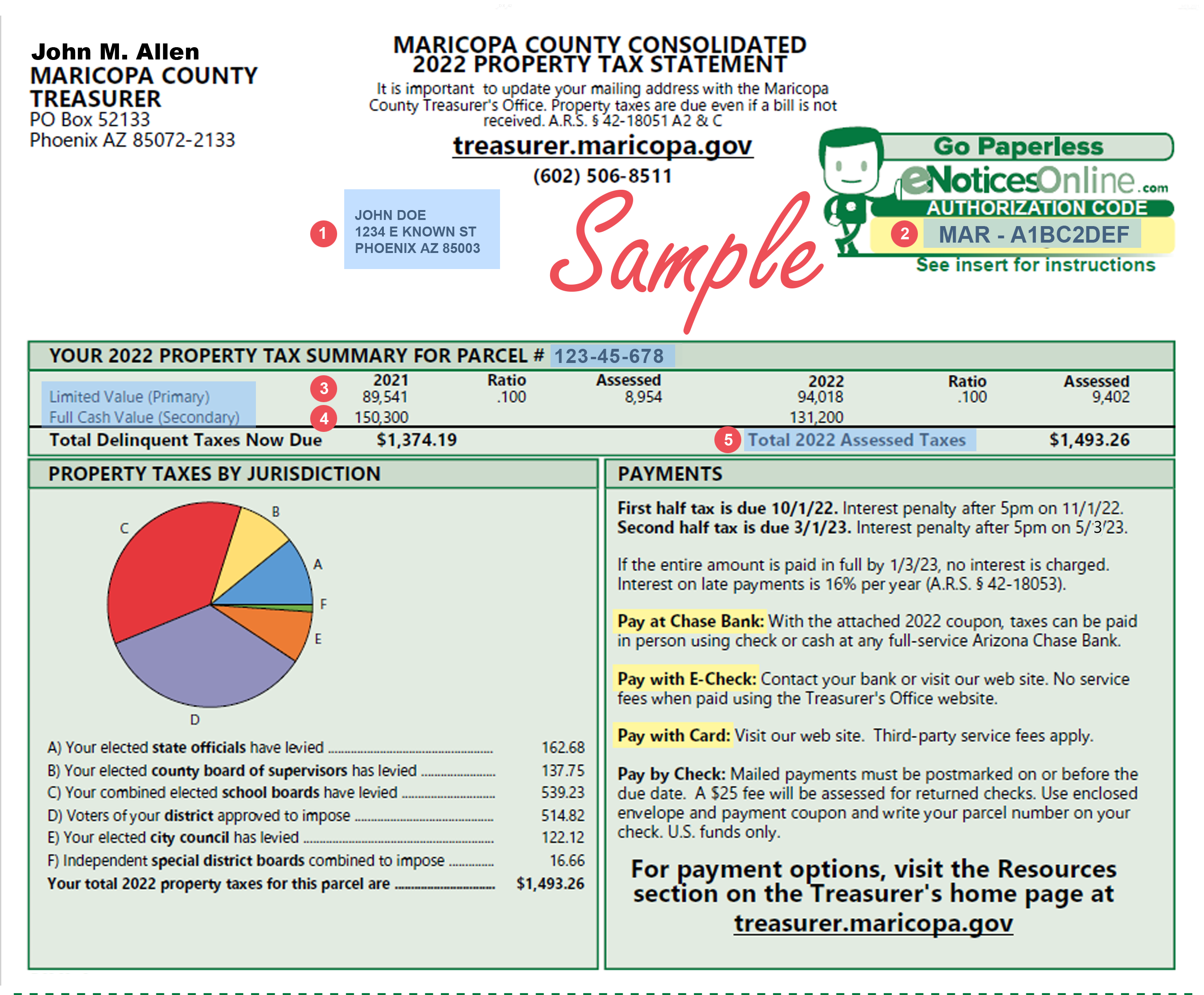

The City collects a secondary property tax which is used to pay the principal and interest due for debt associated with General Obligation bonds. A tax rate is figured by dividing the total secondary property tax levy by the total assessed value in town to determine each property owners share of the levy. Towns and cities use the proceeds from levying property taxes to fund.

A lien is a legal claim against property to secure payment of the tax debt while a. Secondary Property Tax SEC. Visit the Treasurers home page to view important announcements and tax bill information.

Property taxes are one of the primary if not the only ways for municipalities to raise revenue for community services. A levy is a legal seizure of your property to satisfy a tax debt. The Pima County Property Tax Help Line can answer questions about how your property tax was calculated.

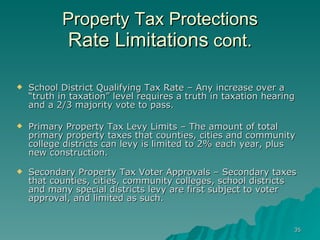

Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. What is an assessed value. Under state law cities and towns are allowed to levy a secondary property tax for the sole purpose of retiring the principal and interest on.

You will need to figure out which of your homes will be considered your primary residence and file your taxes accordingly. Secondary Property Tax Levy debt repayment. What Is A Secondary Property Tax Levy.

SD1 Adjacent Ways - primary tax levy for FUSD to be used for a narrow set of construction improvements or maintenance projects to public ways on district or neighboring property as. A levy is a legal seizure of your property to satisfy a tax debt. Comprised of the total of the obligation for Special Taxing Districts voter approved bonds and budget overrides that are assessed on valuation.

The IRS can garnish wages take money from your bank account seize your property. Secondary property taxes means ad valorem taxes used to pay the principal of and the interest and redemption charges on any bonded indebtedness or other lawful longterm obligation. A tax levy is a legal process that the IRS takes in order to seize the money you owe in taxes.

The City uses the tax levy not the tax rate to. 2 days agoA mill levy override that would generate 235 per student in Denver would raise just 58 per student in property-poor Center. Call 520 724-8650 or 520.

Search the history of tax bills for your property.

Immovable Property Where Why And How Should It Be Taxed Suerf Policy Notes Suerf The European Money And Finance Forum

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

Mrsc Property Tax In Washington State

Overview Of Property Taxes The Majority Of Taxpayers In The City Will Experience An Overall Reduction In Property Taxes They Pay To The City Of Flagstaff Ppt Download

Levies Rates And Values An Faq On Gilbert S Secondary Property Tax Community Impact

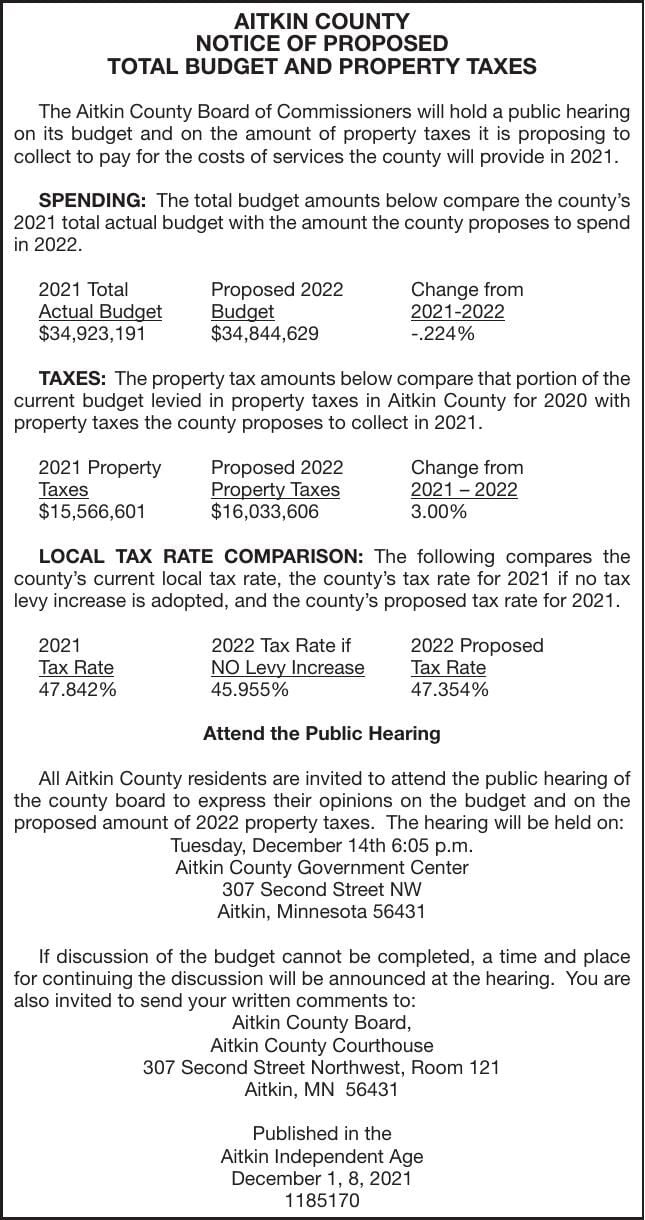

Budget Property Taxes Public Notices Messagemedia Co

Yavapai County Arizona Real Property Tax Information

What Do Property Taxes Pay For Where Do My Taxes Go Guaranteed Rate

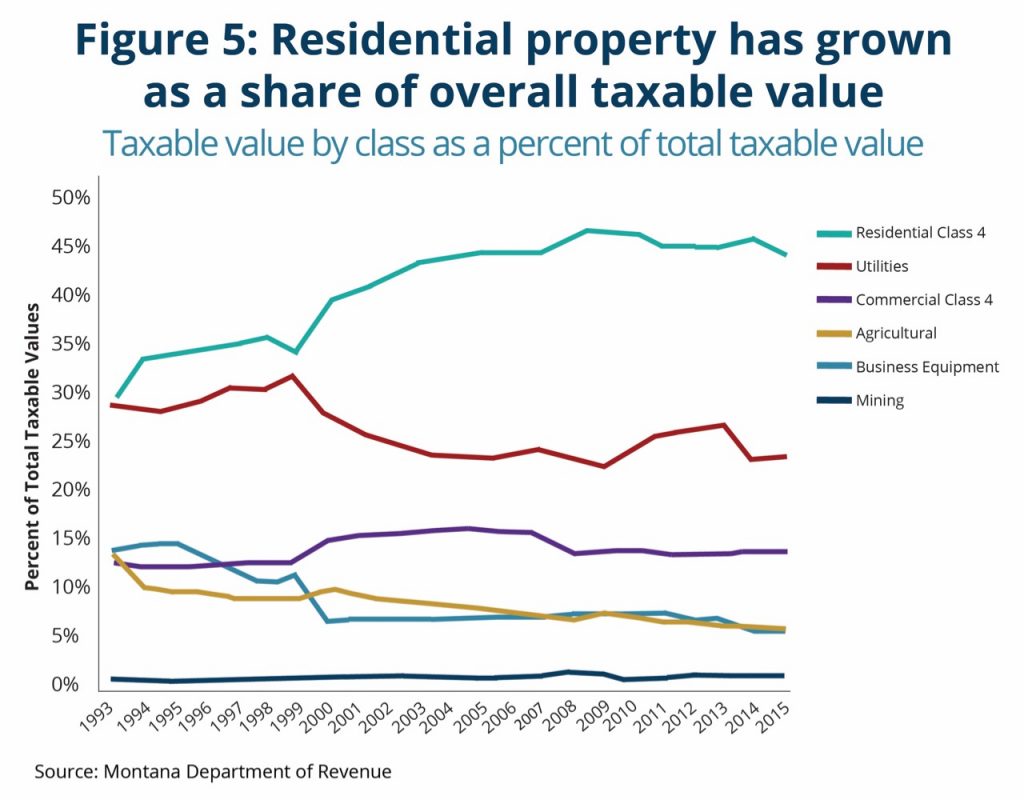

Policy Basics Property Taxes In Montana Montana Budget Policy Center

My Local Taxes Sedgwick County Kansas

The Tax Levy Limit When Is 2 Not Really 2

2022 2023 Sources Of Funds And Uses Of Tax Dollars Pima C

Tax Extension Mchenry County Il

The Property Tax Annual Cycle In Washington State Myticor

Yavapai County Board Of Supervisors Scheduled To Vote On New Tax Rates Signals Az